http://www.theaustralian.com.au/archive/news/not-happy-john-battlers-home-truths/story-e6frg6no-1111114459342

Not happy, John: battlers’ home truths

- JOHN STAPLETON

- THE AUSTRALIAN

- SEPTEMBER 20, 2007 12:00AM

“FOR Sale” signs dot the front yards of the classic suburban houses in Cranebrook, in the heart of the electorate of Lindsay in far western Sydney.

The residents of this marginal seat have one simple message for any politician who claims there is not a housing affordability crisis: “Get out in the real world.”

But they don’t put it that politely.

Lindsay, one of the “Howard battler” seats the Liberals need to keep in order to retain government, is held by outgoing member Jackie Kelly.

But many people who once voted for John Howard – who was urged this week by his own MPs to address the problems of housing affordability – are now struggling to pay their mortgages.

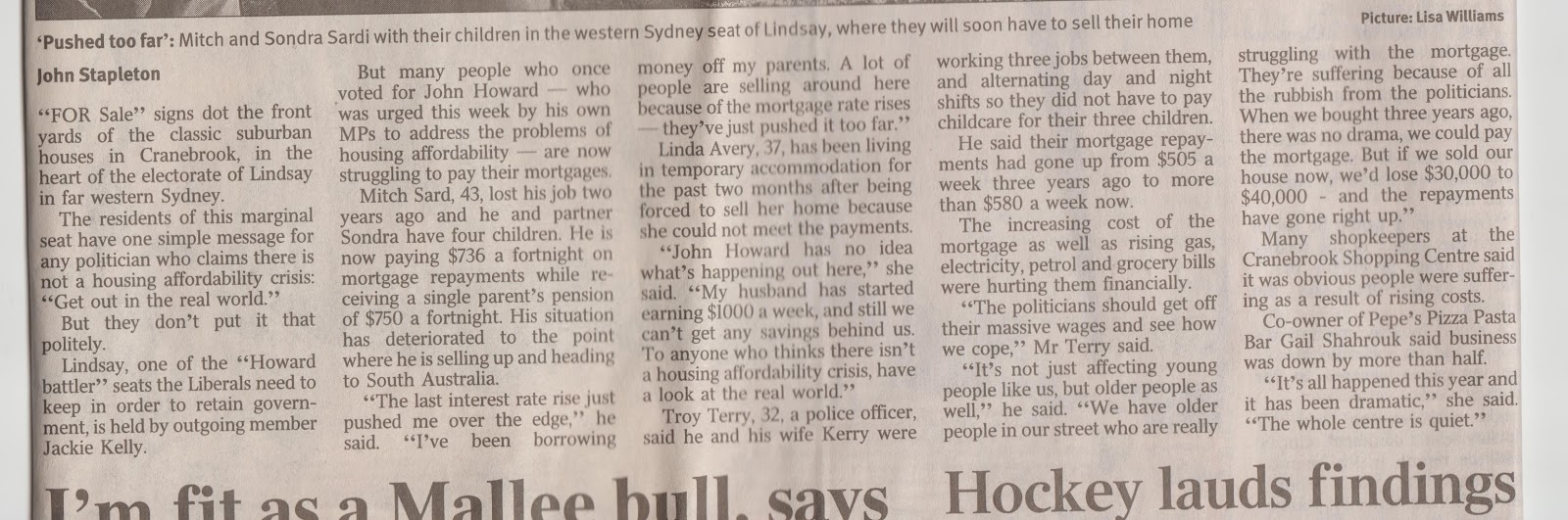

Mitch Sard, 43, lost his job two years ago and he and partner Sondra have four children. He is now paying $736 a fortnight on mortgage repayments while receiving a single parent’s pension of $750 a fortnight. His situation has deteriorated to the point where he is selling up and heading to South Australia.

“The last interest rate rise just pushed me over the edge,” he said. “I’ve been borrowing money off my parents. A lot of people are selling around here because of the mortgage rate rises – they’ve just pushed it too far.”

Linda Avery, 37, has been living in temporary accommodation for the past two months after being forced to sell her home because she could not meet the payments.

“John Howard has no idea what’s happening out here,” she said. “My husband has started earning $1000 a week, and still we can’t get any savings behind us. To anyone who thinks there isn’t a housing affordability crisis, have a look at the real world.”

Troy Terry, 32, a police officer, said he and his wife Kerry were working three jobs between them, and alternating day and night shifts so they did not have to pay childcare for their three children.

He said their mortgage repayments had gone up from $505 a week three years ago to more than $580 a week now.

The increasing cost of the mortgage as well as rising gas, electricity, petrol and grocery bills were hurting them financially.

“The politicians should get off their massive wages and see how we cope,” Mr Terry said.

“It’s not just affecting young people like us, but older people as well,” he said. “We have older people in our street who are really struggling with the mortgage. They’re suffering because of all the rubbish from the politicians. When we bought three years ago, there was no drama, we could pay the mortgage. But if we sold our house now, we’d lose $30,000 to $40,000 – and the repayments have gone right up.”

Many shopkeepers at the Cranebrook Shopping Centre said it was obvious people were suffering as a result of rising costs.

Co-owner of Pepe’s Pizza Pasta Bar Gail Shahrouk said business was down by more than half.

“It’s all happened this year and it has been dramatic,” she said. “The whole centre is quiet.”